Limited Liquidity: A lot of the alternative assets that could be held within an SDIRA, like real-estate, personal fairness, or precious metals, will not be conveniently liquidated. This may be an issue if you should accessibility money promptly.

And since some SDIRAs for example self-directed classic IRAs are matter to essential bare minimum distributions (RMDs), you’ll must program ahead to make sure that you have plenty of liquidity to meet the rules established through the IRS.

An SDIRA custodian differs since they have the suitable staff, knowledge, and ability to take care of custody of the alternative investments. The first step in opening a self-directed IRA is to find a supplier that is certainly specialised in administering accounts for alternative investments.

Right before opening an SDIRA, it’s crucial to weigh the prospective positives and negatives based on your specific monetary ambitions and chance tolerance.

The tax advantages are what make SDIRAs beautiful For several. An SDIRA may be both common or Roth - the account type you choose will depend largely on your investment and tax technique. Examine using your money advisor or tax advisor when you’re Doubtful which happens to be most effective for yourself.

Entrust can assist you in purchasing alternative investments with your retirement resources, and administer the shopping for and providing of assets that are usually unavailable by way of banking institutions and brokerage firms.

Imagine your friend may be commencing the following Facebook or Uber? With the SDIRA, it is possible to put money into brings about that you think in; and perhaps get pleasure from increased returns.

Indeed, real-estate is one of our customers’ most popular investments, sometimes termed a housing IRA. Purchasers have the option to invest in every thing from rental properties, professional real estate property, undeveloped land, home finance loan notes and even more.

Being an investor, having said that, your options are not limited to stocks and bonds if you end up picking to self-direct your retirement accounts. That’s why an SDIRA can renovate your portfolio.

Due to this fact, they tend not to advertise self-directed IRAs, which provide the flexibleness to take a position within a broader variety of assets.

Irrespective of whether you’re a economical advisor, investment issuer, or other fiscal Skilled, examine how SDIRAs could become a robust asset to mature your company and obtain your Qualified aims.

Client Assist: Hunt for a service provider that gives committed assist, which include access to proficient specialists who can reply questions about compliance and IRS guidelines.

Adding cash straight to your account. Remember that contributions are issue to yearly IRA contribution limitations established because of the IRS.

SDIRAs are frequently used by fingers-on buyers who are ready to tackle the pitfalls and responsibilities of selecting and vetting their investments. Self directed IRA accounts will also be great for traders who've specialized knowledge in a niche current market that they wish to spend money on.

No, you cannot spend money on your very own company which has a self-directed IRA. The IRS prohibits any transactions involving your IRA along with your personal business enterprise as you, as being the owner, are regarded a disqualified human being.

Ease of Use and Know-how: A person-friendly platform with on the web instruments to trace your click here to read investments, post files, and handle your account is critical.

Increased investment options signifies you can diversify your portfolio over and above shares, bonds, and mutual resources and hedge your portfolio towards market place fluctuations and volatility.

Have the liberty to speculate in Virtually any kind of asset that has a risk profile that fits your investment method; like assets which have the probable for the next price of return.

Criminals occasionally prey on SDIRA holders; encouraging them to open accounts for the objective of generating fraudulent investments. They normally idiot buyers by telling them that if the investment is accepted by a self-directed IRA custodian, it has to be respectable, which isn’t genuine. All over again, You should definitely do complete homework on all investments you end up picking.

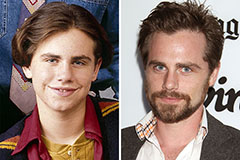

Rider Strong Then & Now!

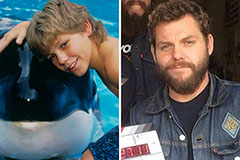

Rider Strong Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!